vermont income tax rate 2020

Pay Estimated Income Tax Online. THE TAX SCHEDULES AND RATES ARE AS FOLLOWS.

What Are Estate And Gift Taxes And How Do They Work

Tax Rates and Charts Mon 01112021 - 1200.

. The taxable wage figures are taken from the quarterly unemployment tax returns you and the benefits are from our submitted record of unemployment benefit claims paid out to your employees. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. The 2022 tax rates range from 335 on.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Individuals Personal Income Tax. Enter 3220 on Form IN-111 Line 8.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Vermonts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont. The rate notice provides you with your new unemployment tax rate. Pay Estimated Income Tax by Voucher.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Detailed Vermont state income tax rates and brackets are available on this page.

Base Tax is of 3220. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Find your pretax deductions including 401K flexible account contributions.

Personal Income Tax - 2020 VT Tax Tables. Find your income exemptions. Details on how to only prepare and print a Vermont 2021 Tax Return.

This marginal tax rate means that. Check the 2020 Vermont state tax rate and the rules to calculate state income tax. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. This form is for income earned in tax year 2021 with tax returns due in April 2022. Vermont State Income Tax Forms for Tax Year 2021 Jan.

Personal Income Tax - 2019 VT Rate Schedules. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. Vermont State Personal Income Tax Rates and Thresholds in 2022.

2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 2020 Vermont State Tax Tables. Below are forms for prior Tax Years starting with 2020.

Monday February 8 2021 - 1200. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022. W-4VT Employees Withholding Allowance Certificate.

PA-1 Special Power of Attorney. Tax Rate Class. We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government.

Filing Status is Married Filing Jointly. VT Taxable Income is 82000 Form IN-111 Line 7. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

RateSched-2020pdf 11722 KB File Format. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902. A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals.

More about the Vermont Tax Rate Schedules. Tax Year 2020 Personal Income Tax - VT Rate Schedules. 2019 Vermont State Tax Tables.

Vermont charges a progressive income tax broken down into four tax brackets. 2021 Vermont State Tax Tables. 2019 VT Tax Tables.

Vermont Tax Brackets for Tax Year 2020. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. Find your gross income.

Read the Vermont income tax tables for Married Filing Jointly filers published inside the Form IN-111 Instructions booklet for more information. Vermont also has a 600 percent to 85 percent corporate income tax rate. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Vermont State Payroll Taxes. 2020 Vermont Tax Rate Schedules Example.

These back taxes forms can not longer be e-Filed. Meanwhile total state and local sales taxes range from 6 to 7. For Adjusted Gross Incomes IN-111 Line 1 exceeding 150000 Line 8 is the greater of 1 3 of Adjusted Gross Income.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Your average tax rate is 1198 and your marginal tax rate is 22. TaxTables-2020pdf 27684 KB File Format.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Now that were done with federal payroll taxes lets look at Vermont state income taxes. Vermont Income Tax Return.

Monday March 1 2021 - 1200. It is sent out annually in June and the rate is effective from July 1st until June 30th. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

Vermont Income Tax Calculator Smartasset

Total Alcohol Consumption Per Capita By U S State 2020 Statista

Maine Skyline Portland Head Lighthouse Print Maine Wall Art Maine Print Portland Head Maine Wall Art Loose Petals Art Style E8 O Mai

Tax Foundation On Twitter South Dakota Inbound Map

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Brackets 2020

State Payroll Taxes Guide For 2020 Article

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Star Studded Line Up On Judging Panel Announced For Wirex And The Fintech Times Rising Women In Cr Fintech Forex Trading Tips Cryptocurrency Trading

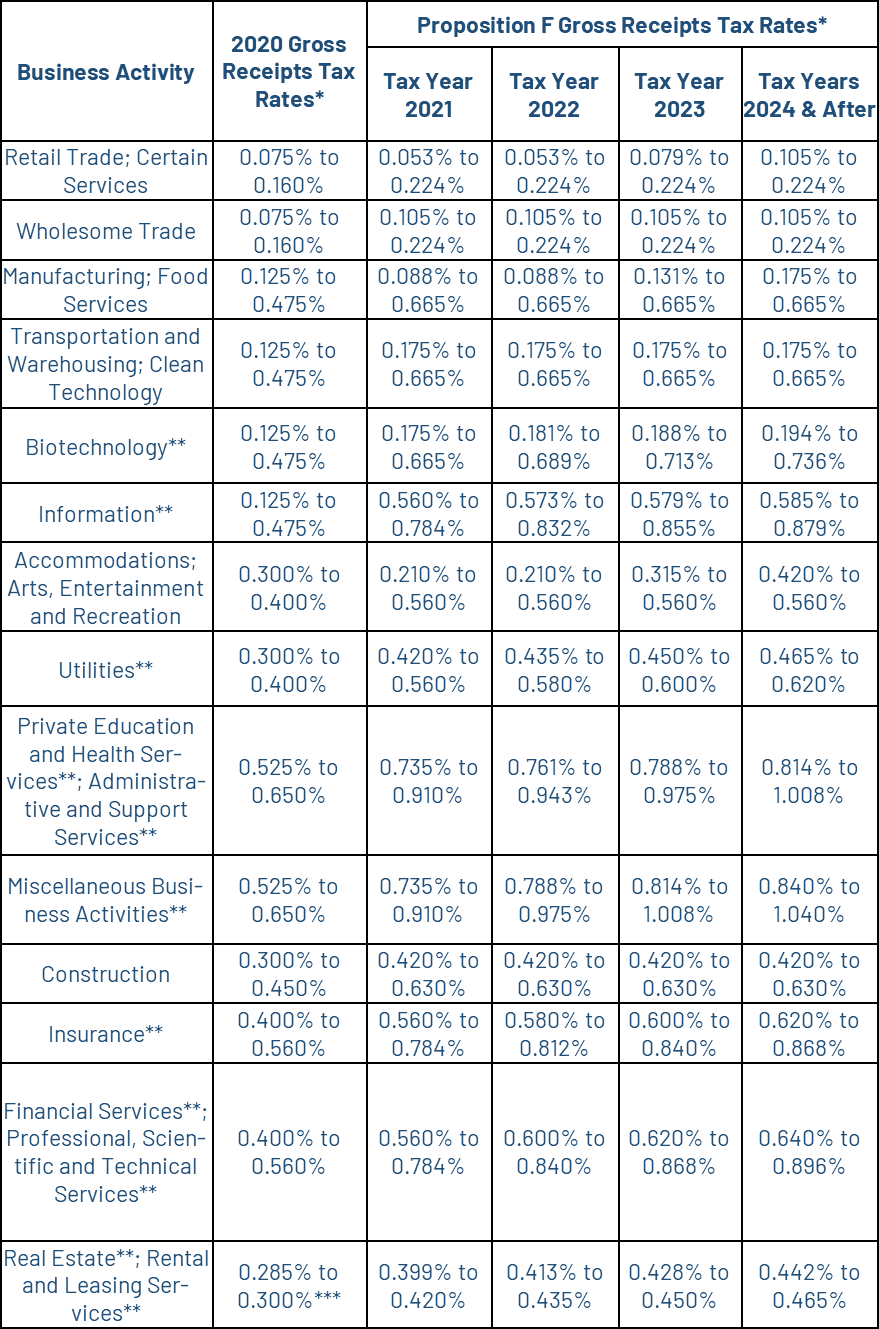

Medicaid Managed Care Spending In 2020 Health Management Associates

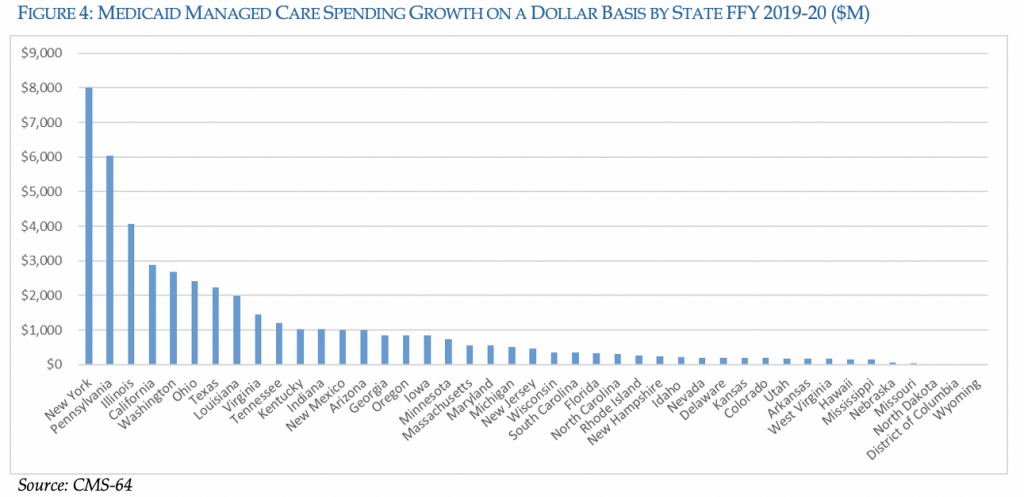

Women S Health Insurance Coverage Kff

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation